Picture this — a bushfire forces you to evacuate, your server crashes out of the blue, or a cyberattack locks you out of everything. Before you know it, your entire business is on pause. So the big question is: could you bounce back quickly, or would that be the end of the road?

For many small businesses across Australia, these kinds of disruptions aren’t just worst-case scenarios—they’re real threats. And without a plan in place, getting back on your feet can take days, weeks, or worse—might never happen.

That’s where a Disaster Recovery Plan (DRP) comes in. It’s not just a fancy document you hope you’ll never use. Instead, it’s your safety net when things go sideways. Because let’s face it, it’s not about if something goes wrong—it’s about when.

A solid DRP helps you act fast, protect your customers, and keep your business running—even during a crisis. Most importantly, it gives you peace of mind, knowing you’ve done the thinking ahead of time.

In this article, we’ll walk you through exactly what a disaster recovery plan is and why it’s a no-brainer for small businesses. You’ll also learn the must-have elements every plan should include, and how to build one that actually works—not just sits in a drawer gathering dust.

By the end, you’ll have everything you need to make your business stronger, more resilient, and ready for whatever comes next.

Why Australian Small Businesses Absolutely Need One

- Firstly, because natural disasters aren’t just headlines—they’re here.

Across Australia, small businesses face serious threats every year. From bushfires in Victoria, to floods in Queensland, cyclones in the North, and sudden power outages across cities and towns, disruptions are all too common. Add to that, the growing risks of cyberattacks and human error, and it’s clear—no business is immune.

- Secondly, because every hour offline hits your bottom line.

Let’s be real—when your business is down, the clock is ticking. Each hour you’re offline, you lose sales, staff sit idle, and your reputation takes a hit. According to CPA Australia, a well-prepared DRP is one of the smartest ways to cut that downtime and avoid major financial pain.

- Thirdly, because your customers expect reliability.

These days, customers have little patience for delays. So if your systems crash, and you’re offline for days, they might simply move on. On the flip side, recovering quickly shows professionalism—and keeps their trust intact.

- Finally, Because it helps with insurance, compliance, and peace of mind.

In many industries, having a DRP isn’t just a smart move—it’s a requirement. Some insurance providers, especially in high-risk sectors, may even ask for a documented plan before processing claims. Likewise, if you’re working under specific compliance frameworks, having a DRP can help tick that box.

The 5 Essential Steps to Disaster Recovery Planning: Your Pathway to Recovery

Getting Started Doesn’t Have to Be Overwhelming

Let’s be honest—building a disaster recovery plan might sound like a big job. However, when you break it into five simple steps, it becomes much more manageable. Most importantly, just starting the process is better than doing nothing at all.

Step 1: Assess Your Risks & Business Impact

(What Could Go Wrong—Specifically for Your Business?)

First, look closely at your specific business setup—your location, how you operate, and who relies on you. Because every business is different, you need to think about the threats that are most likely to hit you.

For example, if you run a café in Brisbane, your risks might include a coffee machine breakdown, power outage, or POS system crash. Meanwhile, a regional e-commerce store might worry more about internet blackouts, bushfire danger, or online security breaches.

Once you’ve listed those threats, ask: “How badly would this hurt my business?”

This is called a Business Impact Analysis—but don’t let the name scare you.

Simply put, think about how each type of disaster would affect your income, your customers, your reputation, and even your legal obligations. Then, prioritise the ones with the biggest potential impact.

Two Key Terms to Know: RTO & RPO

At this stage, there are two helpful concepts to understand:

- Recovery Time Objective (RTO): This is how quickly you need to get back online. Let’s say, if your online shop can’t be down for more than four hours, then your RTO is four hours. So essentially, it’s the time window you have to recover.

- Recovery Point Objective (RPO): This tells you how much data you can afford to lose. For instance, if losing an hour’s worth of sales data would be a disaster, then your RPO is one hour. Therefore, your backup needs to happen at least every hour.

To visualise it, think of RTO as how fast you need to reopen your doors, and RPO as how much stock you’re okay with losing when you do.

Step 2: Identify Critical Business Functions & Resources

(What ABSOLUTELY Must Keep Running?)

Next, figure out what parts of your business are non-negotiable. Which systems, people, or processes must keep going, even if everything else stops?

For example, processing payments, talking to customers, tracking inventory, and accessing key files are usually essential. After that, map out what supports those things: staff, software, hardware, documents, and suppliers.

Because when disaster strikes, these are the moving parts that need to be recovered first.

Step 3: Develop Recovery Strategies

(How Will You Get Back on Track?)

Now that you know what’s critical, it’s time to decide how you’ll recover those pieces after a disruption.

What Should Your IT Disaster Recovery Plan Include?

To start, you need a solid data backup and restoration strategy.

- The 3-2-1 rule is your best friend: Keep three copies of your data, on two different media (like cloud + USB), with one copy stored offsite (preferably in the cloud).

- Ask yourself, how often is data backed up, where is it stored, and how quickly can you restore it?

Then, consider hardware and software recovery.

- If a laptop fries or a POS system fails, do you have replacements or backup systems?

- Also, are your license keys, install files, and passwords saved in a secure, offsite spot?

Next, think about network and connectivity.

- If the internet goes down, do you have a mobile hotspot?

- And if your local network crashes, how will you get staff online again?

Equally important, don’t forget cyber security.

- After restoring systems, update antivirus software, change passwords, and make sure multi-factor authentication is enabled.

- Because otherwise, you risk getting hit again while you’re still recovering.

Finally, keep a list of your key IT contacts:

- Your IT support person, software vendors, internet provider—anyone you’d need to call in an emergency.

Hot Sites, Warm Sites, Cold Sites: Do You Really Need One?

When it comes to physical recovery, you may hear terms like “hot site” or “cold site.” Simply put, these are different types of backup locations—places you could move your business operations to if your main office or shop becomes unusable.

- A hot site is like having a second office that’s fully set up and ready to go. It’s equipped with computers, internet, phones, and access to your business systems, so you can switch over and keep working almost immediately. Because it’s always “on,” it’s also the most expensive option—usually something only big businesses can afford.

- A warm site is a middle-ground solution. It has the building and basic setup like power and internet, but you’d still need to bring in your own computers and load your data. So while it’s not instant, you can get back to work reasonably quickly, and it’s more affordable than a hot site.

- A cold site, on the other hand, is basically just an empty room. It might have electricity and air conditioning, but no equipment, software, or internet. That means, if disaster strikes, you’d need to bring in absolutely everything before you could even start recovering. It’s cheap, but recovery takes the longest.

For most Australian small businesses, the good news is you don’t need a physical backup office at all. Instead, cloud-based tools and remote work have made disaster recovery far more flexible—and much more affordable.

- If you’re already using cloud storage, online software like Microsoft 365 or Xero, and your team can work from home or anywhere with internet…

- Then guess what? You’ve already got a modern “hot site in the sky.”

Don’t Forget the People Side

Also, make sure everyone knows their role.

- Who leads the recovery effort?

- Who contacts customers, suppliers, and staff?

- How will you send updates if email or phones are down?

And if your office is out of action, where will your team work from?

- Home? A shared workspace? A local café with Wi-Fi?

- Having a plan in place, even if it’s basic, is better than panicking later.

Step 4: Test Your Plan

(Does It Actually Work Under Pressure?)

A plan that sits on a shelf gathering dust isn’t much use.

So regularly, test it in small, realistic ways.

- Try a tabletop exercise: Walk through a made-up emergency with your team.

“If the power goes out right now, what’s step one? What’s step two?”

This makes it real, without needing a full-blown drill. - Restore a backup: Pick a key file or system and actually restore it.

If something’s broken, it’s better to know now than later. - Test your emergency messages: Send a dummy alert to your staff list.

If anyone misses it, tweak the system.

After each test, write down what worked and what didn’t.

That way, you can improve and refine your plan each time.

Step 5: Maintain and Update Your Plan

(Keep It Current & Relevant!)

Just like your business, your disaster recovery plan isn’t static.

So ideally, review it at least once a year.

However, update it sooner if:

- You’ve added new software or systems.

- A key staff member leaves.

- You’ve moved office or added locations.

- You haven’t tested backups in ages—or can’t remember where they are.

Also, don’t rely on one person to know the whole plan.

If they’re away, everyone else needs to step in confidently.

Most importantly, assign someone to own the plan.

Even if it’s just you as the business owner, having someone responsible makes all the difference.

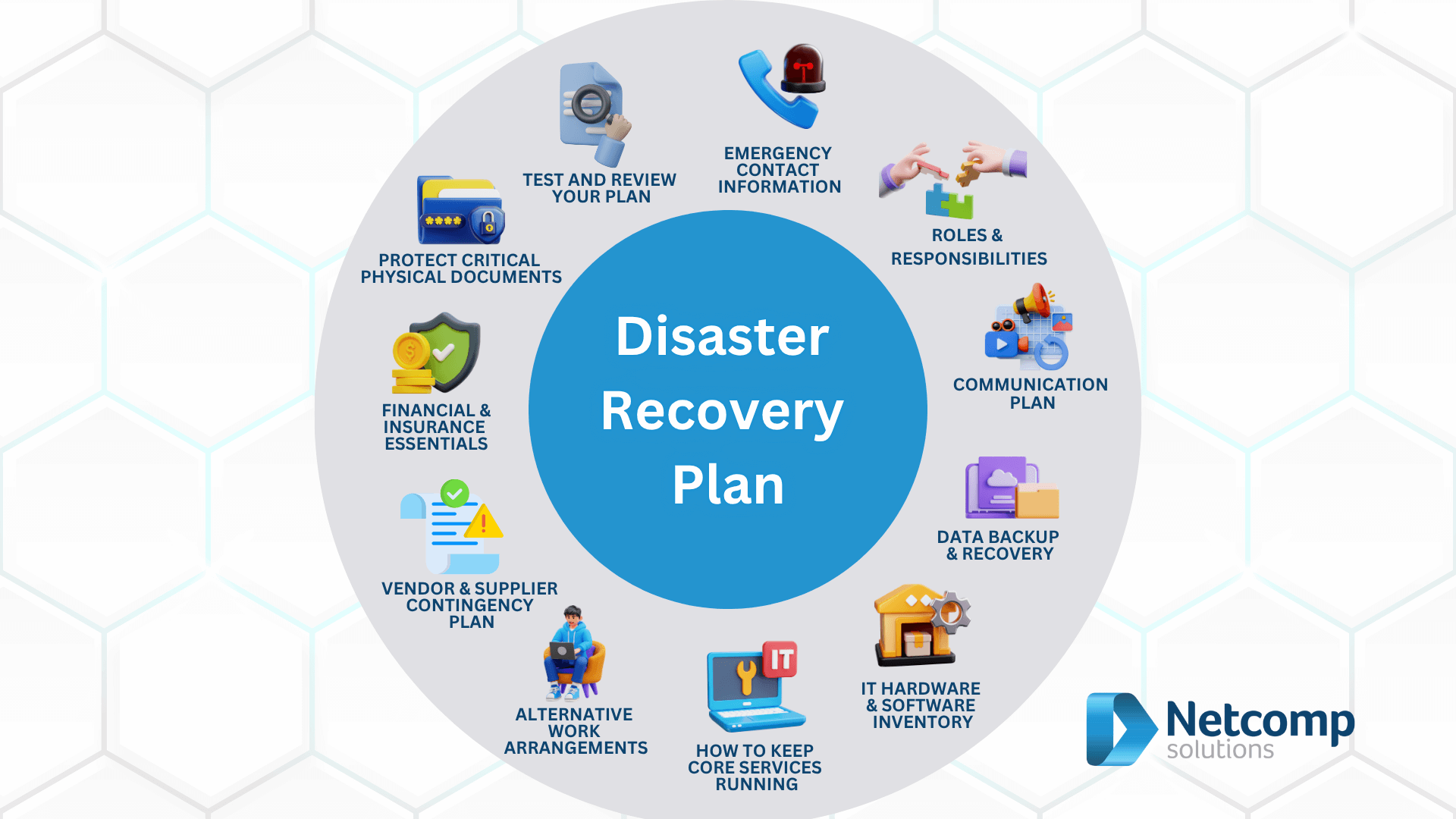

What Every Disaster Recovery Plan Must Include: Your Aussie DRP Checklist

Now that you understand the key concepts, it’s time to put together your Disaster Recovery Plan (DRP).

Think of this checklist as your practical blueprint for staying calm, keeping your business running, and bouncing back fast—even when the unexpected hits.

1. Emergency Contact Information

Make sure this list is up-to-date, printed, and stored somewhere safe—plus saved in the cloud.

- Key team members (both work and personal contact details).

- Local emergency services (000 for Police, Fire, Ambulance; local SES number).

- Critical suppliers (e.g., internet, phone, cloud, electricity).

- Professionals you rely on—like your insurer, accountant, bank manager, and lawyer.

2. Roles & Responsibilities

Clearly define who does what during a disaster.

Make sure everyone knows their job and who they report to if something goes wrong.

3. Communication Plan

How will you stay in touch when things go pear-shaped?

- Notify staff quickly via SMS, WhatsApp, or a communication app.

- Update customers via social media, email, or a banner on your website.

- Pre-write a few messages now—so you’re not scrambling later.

4. Data Backup & Recovery

Document your data safety game plan:

- What data needs backing up, where it’s stored, and how often backups happen.

- How to restore that data when needed (with clear instructions).

- Make sure backup locations (like cloud storage) and login credentials are listed.

5. IT Hardware & Software Inventory

List all your business tech gear:

- Laptops, desktops, servers, EFTPOS machines, etc.

- Software you use, including license keys and download links.

- Contact details for tech support and vendors.

6. How to Keep Core Services Running

Outline the steps to keep your key operations going—even without your usual tools.

- Can you switch to manual payments if EFTPOS is down?

- Is there an offline way to invoice customers?

- Think low-tech backup plans for high-tech tools.

7. Alternative Work Arrangements

If your usual space isn’t usable, where will you work?

- Include remote work setups (VPN access, cloud tools).

- Have a plan B—like working from home, a co-working hub, or a mate’s office.

- If possible, set up a reciprocal deal with another business.

8. Vendor & Supplier Contingency Plan

What happens if your key supplier is affected too?

- List contact info for priority suppliers.

- Identify backup suppliers for critical goods/services—before you need them.

9. Financial & Insurance Essentials

Make sure you have access to:

- Your business insurance policies (especially business interruption cover).

- Emergency funds, savings, or backup credit options.

- Secure bank account details and key financial contacts.

- Tip: Download CPA Australia’s free cash flow forecast template to plan ahead.

10. Protect Critical Physical Documents

Think about your irreplaceable hard copies:

- Contracts, permits, ID, or compliance docs.

- Scan and store digital copies securely in the cloud.

11. Test and Review Your Plan

Don’t wait until a crisis to discover your plan doesn’t work.

- Schedule regular tests (at least once a year).

- Assign someone to review and update the plan.

- Include lessons learned from real incidents or practice drills.

You could download FREE template of a DISASTER RECOVERY PLAN here:

Getting Started: Practical & Australian-Specific Tips for Your Small Business DRP

Don’t overthink it—just get started!

Firstly, the hardest part is often simply beginning. Even a straightforward, no-fuss plan beats having no plan at all. So, take a deep breath and start jotting down what matters most to your business.

Embrace the cloud for resilience.

Secondly, cloud services are a total game-changer for Aussie small businesses. They offer easy, offsite backups, let your team work remotely, and grow with you—all without the headache or cost of maintaining expensive physical hardware.

Use Australian government and local resources to your advantage:

- The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) has great guides on disaster preparedness tailored for small businesses.

- Don’t forget your local council. They often offer business-specific emergency preparedness resources for your area.

- Chat with your insurance broker to understand what your policies cover. They’ll help identify any gaps—especially for Aussie risks like bushfire or flood—and recommend any extras you might need.

Focus on your top three risks first.

Instead of trying to prepare for every possible disaster (which can get overwhelming), pick the three risks most likely to affect your business or cause the biggest impact. Build your first plan around those scenarios, then expand as you go.

Get expert advice when you need it.

If tech stuff or planning feels too much, consider hiring an IT managed services provider (MSP) or a business continuity consultant. They can help set up your plan, run tests, and keep things up to date so you don’t have to go it alone.

Remember the human side.

Beyond systems and backups, make sure your plan looks after your people. Think about how you’ll keep staff safe, informed, and able to work or communicate effectively during tough times.

Conclusion

A solid Disaster Recovery Plan isn’t just about preparing for the worst—it’s about setting your business up for long-term success. It gives you confidence, continuity, and clarity when it matters most. More than that, it protects everything you’ve worked so hard to build. In a world full of uncertainty, being prepared puts you one step ahead.

So don’t wait until something goes wrong.

Start today. Look at your biggest risks, make sure your data is backed up safely, and put together a simple contact list of who to call if things go sideways. That small first step can make a huge difference down the track.

And remember—

With the right plan in place, your Aussie small business won’t just survive a crisis. You’ll be ready to keep going strong, whatever comes your way.