Scammers continue to target Australian businesses, causing substantial financial losses each year. In 2024 alone, Australians reported $2.03 billion in scam-related losses, according to data from National Anti-Scam Centre. Although this figure represents a 25.9% decrease from 2023, businesses remain a prime target. Additionally, Australians lodged 494,732 scam reports, highlighting the persistent threat fraudsters pose. Consequently, the threat is real, and the impact is devastating. Therefore, this article is your essential guide, providing up-to-date information on the latest business scams targeting Australian companies and, moreover, actionable strategies to protect your livelihood. Undoubtedly, vigilance is key, and proactive measures are your best defense. Ultimately, by understanding the risks and implementing the right safeguards, you can navigate the digital landscape with confidence.

Top Trending Business Scams in Australia

1.Invoice Scams (Business Email Compromise – BEC)

Firstly, let’s delve into the most prevalent threats facing Australian businesses today. Specifically, invoice scams, or Business Email Compromise (BEC), are a major concern. Essentially, scammers send fake invoices or manipulate existing ones, often changing bank details to divert payments. For instance, a recent case saw a construction company lose tens of thousands after a scammer intercepted email communications and altered payment details. Consequently, these scams not only result in significant financial losses but also disrupt operations and damage trust with suppliers.

How they work: Scammers send fake invoices or change bank details on real ones.

Risks: Big money losses, disrupted business, loss of trust.

Example:

📩 Email subject: “Urgent: Updated Bank Details for [Supplier Name]”

Email body: “Dear [Business Name], please note our bank details have changed. Use the following account for future payments: BSB: 123-456, Account: 78901234. We apologize for any inconvenience.”

2.Investment Scams/Ponzi Schemes

Secondly, investment scams and Ponzi schemes continue to lure businesses with promises of unrealistic returns. Indeed, scammers often exploit the desire for quick profits, but, in reality, these “get-rich-quick” schemes are inherently risky. Moreover, numerous local investment scams have surfaced, promising high returns on crypto or other investments, only to vanish with the funds. Therefore, businesses must exercise extreme caution when presented with such opportunities.

How they work: Scammers promise very high returns to lure businesses.

Risks: Losing all invested money, “get-rich-quick” schemes are very risky.

Example:

📢 “Invest in our crypto program! 20% returns guaranteed! Limited spots available!” (Often seen on social media or via unsolicited email.)

3. Online Advertising/Directory Scams

Thirdly, online advertising and directory scams are another common trap. Essentially, businesses are tricked into paying for advertising that either doesn’t exist or is grossly misrepresented. For example, scammers create fake directory listings or inflate website traffic claims to justify exorbitant fees. Furthermore, small local businesses are particularly vulnerable, as they often lack the resources to verify the legitimacy of these offers.

How they work: Businesses are tricked into paying for ads that don’t work or don’t exist.

Risks: Wasting money, targeting small local businesses.

Example:

📲Phone call: “Your business is listed in our online directory. Pay $500 to keep your listing active and get top search results!”

📩Fake email including inflated website traffic numbers.

4. Domain Name Renewal Scams

Additionally, domain name renewal scams are a sneaky tactic. Primarily, scammers send fake invoices for domain renewals, often mimicking legitimate registrars. However, businesses may already have their renewals covered or may not even need the services offered. Thus, it’s crucial to verify all invoices independently.

How they work: Fake invoices for domain renewals that businesses don’t need.

Risks: Paying for services you don’t need.

Example:

📩Invoice: “Domain Name Renewal: [YourBusinessName.com.au] – $250. Payment due immediately.” (Looks like a real invoice, but isn’t from your registrar.)

5. Payment Redirection Scams

Moreover, payment redirection scams pose a significant threat. In essence, scammers impersonate businesses or suppliers and request payments be redirected to fraudulent accounts. For example, they might intercept email communications and provide new bank details, tricking businesses into sending money to the wrong place. Consequently, careful verification is essential.

How they work: Scammers pretend to be businesses and ask for payments to be sent to their accounts.

Risks: Money sent to the wrong place.

Example:

📩Email: “Please send the payment for invoice #123 to our new account: BSB: 654-321, Account: 45678901. Our old account is now closed.”

6. Remote Access Scams

Furthermore, remote access scams are becoming increasingly sophisticated. Fundamentally, scammers convince businesses they have computer problems and trick them into granting remote access to their systems. Subsequently, they can steal sensitive data, install malware, or even demand ransom. Therefore, businesses must be extremely cautious about granting remote access to anyone they don’t fully trust.

How they work: Scammers say your computer has problems and trick you into giving them remote access.

Risks: Stolen data, malware, ransom demands.

Example:

📲Phone call: “Hello, we are calling from windows support, your computer has a virus, please follow these steps so we can fix it”

7. Phishing via Fake File-Sharing Links

Finally, phishing attacks via fake file-sharing links are a growing threat. Essentially, scammers send emails that appear to be from colleagues or partners, enticing victims to click on links leading to fake login pages. Subsequently, when victims enter their credentials, scammers gain access to sensitive company data. Therefore, businesses must be extremely vigilant about verifying the legitimacy of email links, especially those requesting login information.

How they work: Scammers send emails with links to fake file-sharing login pages (e.g., SharePoint), tricking users into entering their credentials.

Risks: Stolen login credentials, data breaches, financial loss, compromised company networks.

Example:

📩Email: “Hi [Employee Name], please review the attached document via this SharePoint link: [fake SharePoint link]. You’ll need to log in to access it.” (The link leads to a replica login page.)

Latest Email Scams in Australia

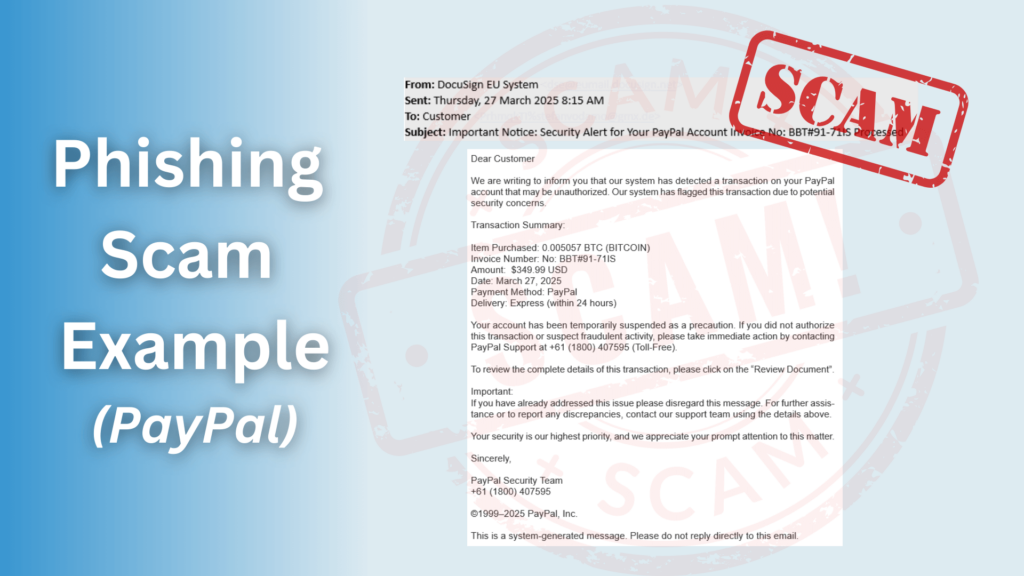

1.Phishing Attacks

Firstly, phishing attacks involve scammers sending fake emails. Essentially, these emails look like they come from trusted sources, such as banks, government agencies, or suppliers. For example, they might ask you to confirm your account details. Moreover, these attacks are becoming very sophisticated. Indeed, scammers now use realistic logos and language.

Example:

📩Email Subject: “Urgent: Account Verification Required”

Email Body: “Dear Customer, your bank account has been temporarily suspended. Please click here to verify your details immediately: [fake bank website link].”

2.Malware/Ransomware Attacks

Secondly, scammers can use email attachments or links to put harmful software on your computer. Specifically, this software, called malware, can lock your files. Then, they ask for money to unlock them, which is called ransomware. Consequently, this can stop your business from working.

Best Practices:

- Firstly, never open attachments or click links from people you don’t know.

- Also, keep your antivirus software up to date.

- Finally, make backups of your important data.

Example:

📩Email Subject: “Your Invoice [random numbers].zip”

Email Body: “Here is your invoice. Please, open the zip file.” (The zip file has malware.)

📩Email Subject: “Warning: Computer Problem”

Email Body: “Your computer has a security problem, to fix this, please click this link and install the fix.” (the link downloads ransomware)

3. CEO Fraud/Impersonation

Thirdly, scammers can pretend to be your CEO or a manager. Then, they ask you to send money quickly. Often, they try to make you feel rushed.

Example:

📩Email from “CEO’s Name”: “Hi [Employee Name], I need you to send $50,000 to this account right now. This is private. Tell me when it’s done.”

4. Business Impersonation Scams

Additionally, scammers make fake websites and emails that look like real businesses. Then, they trick people into giving them money or information.

Example:

🌐A fake website that looks like a well-known office supply company, that takes credit card information, but never sends the product.

📩An email from a fake delivery company, saying you need to pay a fee to get your package.

How to Check if a Business is Legitimate in Australia

1.Australian Business Register (ABR)

Firstly, to check if a business is registered, you can use the Australian Business Register (ABR). Essentially, this website lets you verify a business’s ABN (Australian Business Number) and other registration details. Therefore, it’s a good first step to check if a business is real.

2. ASIC Connect

Secondly, for companies, you can use ASIC Connect. Specifically, this website allows you to check company registrations and director details. Thus, it helps you see if a company is officially registered and who runs it.

3. Online Reviews and Testimonials

Thirdly, checking online reviews and testimonials is very important. Indeed, they can give you an idea of other people’s experiences with the business. Then, you can see if others have had good or bad experiences.

For example, reputable review platforms include Google Reviews, Yelp, True Local, GoodFirms, etc.

4. Verify Contact Information

Finally, always verify contact information independently. Specifically, don’t just use the phone numbers, addresses, or websites given to you by the potential business. Instead, find the information from reliable sources.

Tips on How to Stay Safe From Business Scams

1. Educate Your Staff

Firstly, regular training is crucial. Essentially, your staff should know about the latest scams. Therefore, provide specific examples of what to look out for, like fake invoices or phishing emails. For instance, show them real examples of scam emails and explain the red flags.

2. Implement Strong Security Measures

Secondly, strong security is key. Specifically, use strong passwords and multi-factor authentication (2FA). Also, keep your antivirus software up to date. Furthermore, regularly back up your data. Thus, you can recover your files if you get hit by ransomware.

3. Verify Invoices and Requests

Thirdly, always double-check invoices and payment requests. Especially, be careful with changes to bank details. Then, confirm these changes by calling a known contact number. Therefore, don’t just rely on the information in the email.

4. Be Cautious of Unsolicited Offers

Moreover, be wary of unsolicited offers. Specifically, don’t respond to requests for personal or financial information. Also, watch out for pressure tactics. For example, if someone says you must act immediately, be suspicious.

5. Stay Informed

Additionally, stay up to date on the latest scams. Essentially, use resources like Scamwatch and the ACCC. Thus, you’ll know what to look out for.

6. Have Clear Purchasing and Advertising Policies

Furthermore, create clear rules for buying and advertising. Essentially, this helps staff know what is legitimate. Therefore, they are less likely to fall for scams.

7. Keep Proper Records

Also, keep good records. Specifically, this makes it easier to track payments and find mistakes. Thus, you can quickly spot any discrepancies.

8. Check the Details of Any New Trader

Then, always check the details of new traders before doing business. Essentially, this is a vital step in preventing scams. Therefore, verify their registration and contact information.

9. Implement Two-Factor Authentication (2FA)

Next, use 2FA for sensitive systems. Specifically, this adds an extra layer of security. Thus, even if someone gets your password, they can’t get into your accounts.

10. Conduct Regular Audits

Moreover, do regular audits of your finances and security. Essentially, this helps find any weak spots. Therefore, you can fix them before scammers exploit them.

11. Verify Communications

Finally, always verify unsolicited communications. Specifically, use known contact details to confirm any requests, especially those involving money. Thus, you can ensure the communication is genuine.

How to Report a Scam Business in Australia

1.Scamwatch

Firstly, if you encounter a scam, report it to Scamwatch. Essentially, Scamwatch is run by the ACCC (Australian Competition and Consumer Commission). Therefore, they collect information to help warn others.

2. Australian Cyber Security Centre (ACSC)

Secondly, for cybercrimes like hacking or online fraud, report to the ACSC. Specifically, they handle serious online threats. Thus, if you’ve been a victim of a cybercrime, report it to them.

3. Local Police

Moreover, for serious scams, especially those involving significant financial loss, report to your local police. Essentially, they handle criminal investigations. Therefore, if you believe a crime has been committed, contact them.

4. Banks and Financial Institutions

Additionally, if you’ve had fraudulent transactions, report it to your bank immediately. Specifically, they can help stop further losses. Thus, it’s crucial to act quickly.

Importance of Reporting

Also, remember that reporting scams helps protect others. Essentially, your report can warn other businesses and individuals. Therefore, don’t hesitate to report any suspicious activity.

Conclusion

In summary, staying safe from business scams requires constant vigilance and proactive measures. Essentially, we’ve covered the most trending scams, from invoice fraud and phishing to ransomware and business impersonation. Therefore, it’s crucial to educate your staff, implement robust security measures, and always verify information independently. Furthermore, remember to report any suspicious activity to Scamwatch, the ACSC, and your local police.

If your business needs consultation, tailored solutions, or ongoing support, Netcomp, a local IT Support provider , is here to help ensure your systems remain secure.